The fusion of Decentralized Finance (DeFi) and Artificial Intelligence (AI) has given birth to a new frontier: DeFAI. By blending the transparency of blockchain with the intelligence of machine learning, DeFAI is reshaping how capital flows, how risks are managed, and how financial services are delivered.

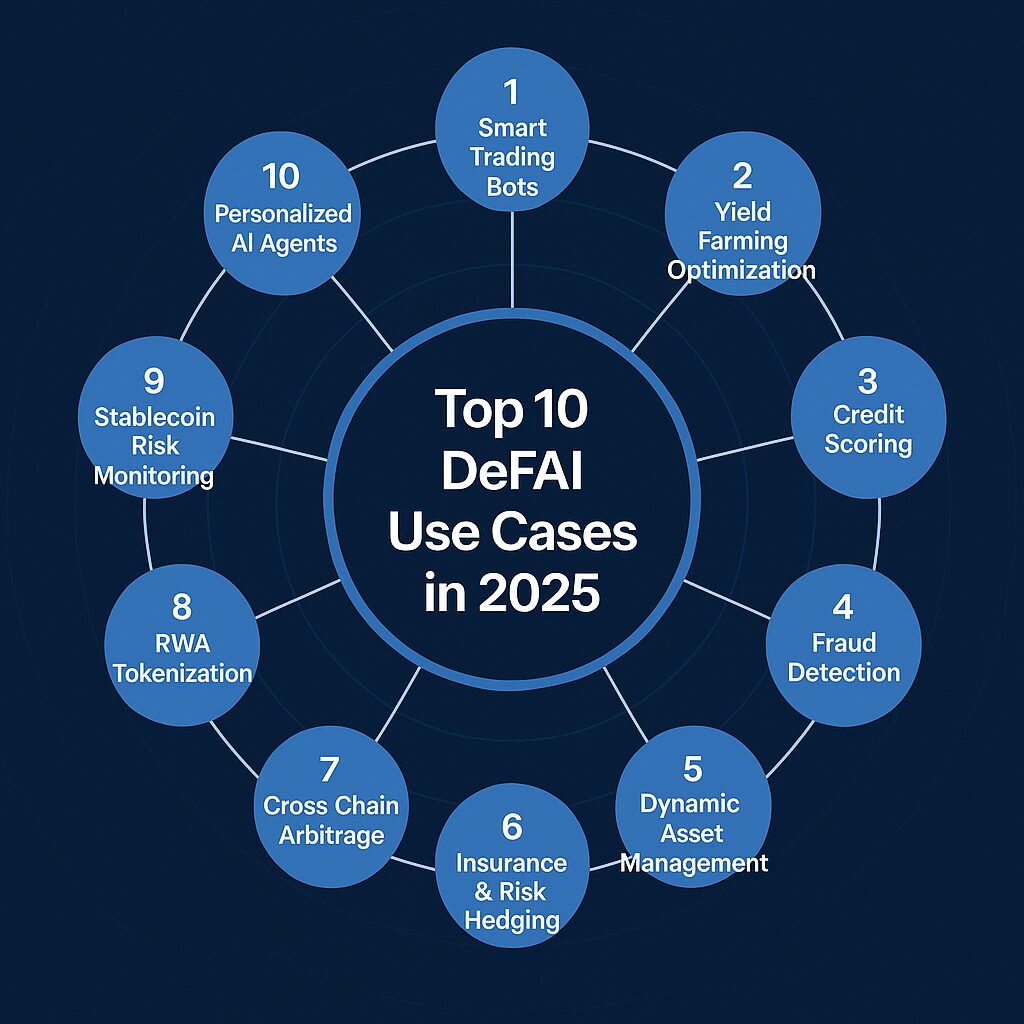

Top DEFAI Usecases

As we step into 2025, enterprises, fintech startups, and investors are increasingly looking at DeFAI solutions to unlock smarter, faster, and more scalable opportunities across the crypto economy. In this article, we explore the top 10 DeFAI use cases in 2025 — from AI-driven trading bots to credit scoring for underbanked populations.

1. Smart Trading Bots with Predictive Intelligence

DeFAI trading bots are no longer just rule-based. By integrating machine learning models with on-chain data, these bots can forecast market movements, identify arbitrage opportunities, and execute trades in real time. On platforms like Solana and Ethereum DEXs, AI-driven bots are optimizing entry and exit strategies, helping investors maximize returns with minimal risk.

2. AI-Powered Yield Farming Optimization

Traditional yield farming requires constant monitoring of APY fluctuations across liquidity pools. DeFAI automates this process by analyzing pool health, liquidity depth, and impermanent loss risks. AI agents dynamically shift funds between DeFi protocols like PancakeSwap, Uniswap, and Cetus, ensuring consistent yield while minimizing exposure.

3. On-Chain Credit Scoring for DeFi Lending

One of the biggest limitations of DeFi lending is the absence of reliable credit assessments. DeFAI models can analyze wallet history, transaction patterns, and behavioral data to generate on-chain credit scores. This enables undercollateralized loans, bringing real-world borrowers and institutions into the DeFi ecosystem.

4. Fraud Detection & AML Compliance

AI algorithms can detect anomalies, flag suspicious transactions, and monitor for money laundering risks in real time. By combining DeFi transparency with AI-powered fraud detection, institutions can build compliant DeFAI lending and payment platforms that meet global regulatory standards.

5. Dynamic Asset Management & Robo-Advisory

DeFAI is driving autonomous asset managers that adjust portfolios in real time. Instead of static DeFi vaults, AI-enhanced strategies adapt to changing market sentiment, volatility, and liquidity. For high-net-worth individuals and institutional investors, this means hands-free crypto portfolio management with improved performance.

6. Insurance & Risk Hedging in DeFi

AI models can predict protocol exploits, default risks, and market drawdowns. DeFAI insurance platforms leverage this data to price policies dynamically and automate claims via smart contracts. This reduces fraud, lowers premiums, and increases trust in decentralized insurance products.

7. Cross-Chain Arbitrage & Liquidity Routing

As multi-chain ecosystems like Sui, Solana, Ethereum, and Polygon expand, liquidity is fragmented across networks. DeFAI bots analyze cross-chain bridges and DEX pools to identify profitable arbitrage trades. Enterprises can leverage these tools to enhance capital efficiency in multi-chain environments.

8. Real-World Asset (RWA) Tokenization + AI Valuation

The RWA tokenization trend is booming, with assets like real estate, carbon credits, and treasury bills entering DeFi. DeFAI enhances this by providing AI-driven valuation models, ensuring fair pricing, risk-adjusted yields, and better investor confidence. This combination is opening up a trillion-dollar DeFAI opportunity.

9. Algorithmic Stablecoin Risk Monitoring

AI can continuously evaluate collateral ratios, market sentiment, and liquidity to prevent stablecoin depegging events. DeFAI platforms use predictive analytics to adjust collateral requirements dynamically, creating safer and more resilient stablecoin ecosystems in 2025.

10. Personalized DeFi Experiences with AI Agents

DeFAI enables autonomous financial agents that act as personal advisors for users. These agents learn from a user’s risk appetite, portfolio size, and goals to recommend investments, manage staking, and even interact with dApps. This personalization makes DeFi more accessible to institutions, enterprises, and retail investors alike.

🌍 Industries DeFAI Will Impact Most

While DeFAI is born in crypto, its impact goes far beyond:

-

Banking & Fintech: Smarter credit and payments.

-

Wealth Management: Autonomous AI advisors.

-

Insurance: Fraud detection and automated claims.

-

Enterprises: Treasury optimization via DeFi.

-

Governments: AML/KYC compliance in digital economies.

⚙️ Key Blockchains Powering DeFAI

Different ecosystems are racing to host DeFAI apps:

-

Ethereum / Polygon (EVM): Largest DeFi ecosystem.

-

Solana: High-performance AI-powered DeFi trading.

-

Sui: Parallelized execution ideal for AI-driven dApps.

-

Hyperledger Fabric: Enterprise-grade DeFAI for banks and governments.

📊 Real-World Example: DeFAI in Action

Imagine a fintech startup offering microloans in Africa:

-

AI models score users by wallet history & mobile data.

-

Loans are issued via DeFi lending protocol.

-

Repayments are monitored by smart contracts.

-

Insurance is auto-triggered if defaults spike.

This single platform could bank millions of underbanked users with no centralized authority.

❓ FAQ on DeFAI

1. What is DeFAI?

DeFAI = Decentralized Finance + Artificial Intelligence, where AI agents power decision-making inside DeFi protocols.

2. How is DeFAI different from normal DeFi?

Traditional DeFi is rule-based. DeFAI is adaptive, predictive, and autonomous, driven by real-time AI models.

3. Is DeFAI safe?

Like any emerging tech, risks exist. But AI risk monitoring, fraud detection, and compliance engines make DeFAI safer than legacy DeFi.

4. What are the best blockchains for DeFAI development?

Ethereum, Solana, and Sui are leaders, but enterprise chains like Hyperledger are rising too.

5. Who can benefit from DeFAI?

-

Retail users: Smarter yields, safer assets.

-

Enterprises: Automated treasury & risk management.

-

Banks & Governments: Compliance-ready decentralized solutions.

🚀 The Future of DeFAI: Smarter, Safer & Scalable

By 2025, DeFAI is no longer just a buzzword — it’s a practical technology transforming fintech, banking, and Web3. From smart trading bots to AI-powered credit scoring, these use cases are pushing decentralized finance toward greater efficiency, security, and inclusivity.

At TAS.co.in, we specialize in building AI-driven DeFi platforms on Solana, Sui, and EVM blockchains. Our expertise in blockchain development, AI/ML integration, and custom automation helps startups, enterprises, and institutions unlock the full potential of DeFAI.

✅ Ready to build your own DeFAI-powered platform?

Let’s turn your idea into a scalable, future-proof solution. Get in touch with us today and start building the next generation of decentralized finance.